Beer on the economy

October 2014

The UK recovery to date

The UK economy continues to grow. However, there are some signs the rate of expansion is lower than earlier in the year. Latest Markit/CIPS PMI survey data show the growth rate in manufacturing slowing in particular. The much larger services sector continues to grow at a good rate. Overall, the Composite PMI figure for the UK (which brings together surveys of manufacturing, construction, and services) was down slightly in September.

Industrial production data for August was unchanged on the month, and the more volatile construction output figure was lower. The overall picture from the data seems to be that GDP growth may have been slightly lower in the third quarter compared to April - June.

However, later revisions of the data are, as often, likely to change the picture. For example, the Office for National Statistics (ONS) revised its estimate of Q2 GDP growth up slightly to +0.9%, while revising Q1 down slightly. The overall picture remains that the economy grew 3.2% in the twelve months to June. Headwinds for the UK economy include a slowing of activity in the Eurozone, particularly Germany. That could affect our exports and is just one reason why we have a vested interest in the success of the Eurozone economies. The first estimate of GDP for July-September is expected to be published on Friday (24 Oct).

More on revisions - recovery looks different but trend little changed

The UK data revisions were part of the final set of major revisions the ONS has been undertaking. The revisions are partly connected with new data and partly due to changes in methodology being applied in various countries. The revisions mean the UK economy regained its pre-recession size last year rather than this year. It had been thought that investment played little part in the recovery, but revisions and reclassifications mean investment is estimated to have contributed to 45% of GDP growth since the recession. The overall picture, of recovery stalling in 2010-11 (when economic turmoil in the Eurozone combined with announcements of austerity in the UK) before growth significantly picks up, is unaffected.

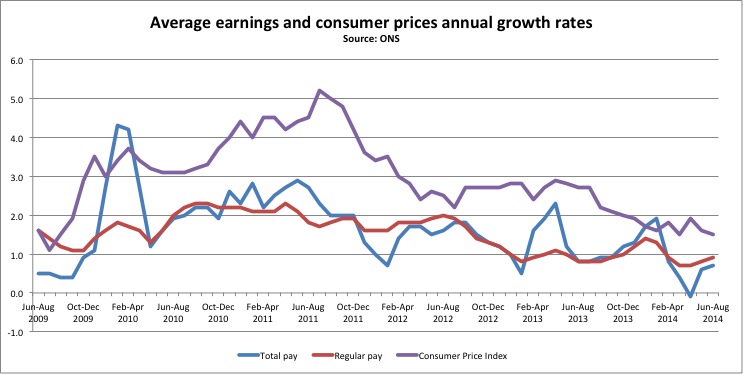

Wages and prices - cost of living

Average wages continue to grow more slowly than inflation, meaning a real terms pay cut for people. The gap is narrower than it was, with regular wages rising 0.9% on the year and inflation at 1.2%. The chart below shows wage growth and inflation since 2009 to August. Wages have been behind inflation most of that time, and of course for some time before too.

With the oil price falling over 25% over the past three months or so, there is likely to be be more downward pressure on inflation in the near future.

Productivity

One of the mysteries of the recovery is, why has productivity failed to bounce back strongly? The answer is, no one knows for sure. Productivity (output per hour worked) is approximately 16% beneath the pre-recession trend, according to the ONS. On the other hand, GDP growth is well below the pre-recession trend too. Employment has grown strongly in this recovery and unemployment did not rise as far as the downturn implied it would do, based on previous occasions (the unemployment rate is now 6%). Also, it seems productivity has fallen in the oil & gas industry (employing more people?), financial services (mainly lower output), and government services sectors.

The hope is that the increase in employment will lead to higher output as spare capacity is used up. But the extent that happens will depend in part on the type of new jobs and how many people in work are underemployed. Has the recession and recovery reshaped the British economy by accelerating existing trends, much as did the 1980s recession (then deindustrialisation, now new technology)? Time will tell, and we should note it is better for people to be in work than out of work (which is why government should be employer of last resort). Meanwhile, the country needs more public investment to boost future productivity.

Latest on the battle for economic credibility

The key requirement for Labour is to build economic credibility with voters. In an article for Progress before the Labour Conference I stressed this point in the light of recent polling suggesting a widening gap between the parties on economic credibility. As time passes, our room for manoeuvre on economic policy narrows unless we are clearly committed to showing how we mean to control spending and promote growth It is no surprise that the Conservatives are promising tax cuts ahead of the election as their answer to the cost of living crisis, despite the promise undermining their own claims to be credible on the economy (and borrowing still high). Our overall theme should be one of investment in our future, as outlined in The Credibility Deficit.

Additional: Labour, Iraq & Syria, and the need for a bold stance

The Conference season began as elsewhere the focus on Iraq and Syria was increasing. At Labour Conference I campaigned with Christians on the Left for the Party to take a stronger stand on the plight of Christian and other minorities. Parliament debated and approved military action in Iraq (but not Syria, which was ridiculous): I published a guide to voting on military action. Writing for The Tablet I also called for more effort on ethics and planning during and after action.

The vote for military action should not have been the end of the matter here in the UK. Our contribution is relatively small, a result of woeful defence planning over the past few years. Over a million people are displaced and now refugees are facing the onset of winter while living in often inadequate tents and other shelters. The UNHCR estimates its aid effort is only 50% funded. The conflict continues, as does the murder, rape and sex slavery, and other atrocities. Meanwhile, there is also a growing security threat to the UK itself. Labour can and should now take a bolder stance on this issue.

October 2014, 23/10/2014